Term life online - term versus whole life comparison

We'll spare you the usual cliches.

"Term is like renting life insurance!"

You look across the web and you'll see lots of bad analogies.

Hey life insurance people aren't writers!

And writer's don't sell life insurance!

But....

If you're looking for life insurance coverage, one of the first questions will be..

Okay, maybe not the last one but without understanding term versus whole insurance, you might as well ask it!

Let's get started.

You can jump to any of these topics here:

Lots to cover.

Let's get started.

You can always quote term and whole life here:

Our assistance is 100% free to you. Just call at 800-710-0455 or email us.

Let's start with the basics.

Term life is just like renting life insurance.

Sorry...I had to.

Seriously, here's the definition of term life:

That's not too bad.

You basically are picking a range of time to cover the unlikely (hopefully) event of a death.

Here are the usual period of times:

In addition to this "term" or period of coverage, there's the face amount of coverage.

This can range from $5K to over a $1M.

$250, $500K and $1M are very common break points in coverage for term life.

Here's the deal...

After your period of time ends, the coverage ends.

20 years comes around and you're still causing trouble on this earth, that's it!

The coverage ends.

Good news is that you didn't!

What's the trade off?

Cost!

Term can be very affordable.

We'll touch on this later.

Next up...whole life.

Whole life is the typical alternative to life term life.

The quick definition:

So what does this really mean?

There are two big differences. Actually three.

The first two are structural.

As long as you pay the premium, the policy will pay a death benefit.

Whether the event occurs the following month or at age 99.

We'd like 99 please!

The other structural difference is the cash value element.

Traditionally, whole life has a smaller immediate death benefit and then builds on it with a cash value element over time.

What's the third element we mentioned above?

That's a big deal.

We'll get into how to compare the two options especially in light of the cost difference.

Let's look at how to compare term and whole life.

Let's remember the goal.

Ultimately, we're trying to cover the loss of income for a period of time (usually).

In light of that, let's look at how term and whole life are different:

Term life is much less expensive. Usually 10x's less.

Term life will end at some point.

Whole life will not (unless you stop paying premium).

Term life only pays a benefit in the event of the insured passing way.

Whole life will build up a cash value over time that you can borrow against or draw down.

Those are the core differences between the two policies.

This brings us to the key question...which is better?

In most cases, we have to go with term life.

For a very simple reason.

Cost!

Let's look at an example based on how people really work.

Let's say we have $50K income to replace in case a person passes away.

This could also be $500K mortgage and expenses to cover.

However you want to view that.

Now...term life for a given person may be $50/month for this amount with a 20 year term.

(age, area, and other factors affect this pricing).

What about whole life?

Here's the issue.

Whole life for a $500K face value might be $500/month!

That's not doable for most people.

It's probably not advisable for many more!

The proponents of whole life (usually someone who's financial interest is intertwined with you buying it) will say...

But at what cost!

What if we just took the $450 extra we would spend on the whole life and invested it.

Ummm...no brainer.

That's exactly what the life insurance company is going to do with it.

In the meantime, they'll pay for their profit. Their overhead. Their very large, beautiful buildings.

On your dime.

Look...we are life insurance agents but it's hard to justify this approach.

Now you have no life benefit and you paid out all that money.

We see it all the time.

Okay but the point of life insurance is to cover an unforeseen (and unexpected) death benefit.

If the insured passes away in year 2, you may have a whopping $10K life benefit.

Why even have coverage at that point.

Exactly!

There are very limited uses of whole life but they don't apply to vast majority of Americans.

You can quote both term and whole life together here:

Of course, we're happy to help you with any questions at 800-710-0455 or by email.

We want to help you find the policy you want to keep!

There can be options to convert term into permanent coverage depending on the policy and riders available.

Ask us about which term life policies can be converted into whole insurance.

Call 800-710-0455 or email.

Not even a contest.

Term life is cheaper.

So much so that it's hard to justify going with whole life.

You can take the different in cost and invest it for the "cash value" aspect of whole life.

The purpose of life insurance is to cover the financial toll of an unexpected death.

It's like having a health plan with no copays and no deductibles.

Those all went away!

Whole life covers a risk that is guaranteed to happen so you're going to pay more than it's worth by definition.

Otherwise, that would be a losing business.

Get term life and use the savings to invest.

This depends on a host of factors:

Here's the deal.

Each life insurance carrier has specific niches in which they excel!

The actual rate comes back based on many different variables.

We need AI to actually cross reference all that can affect it!

Until our robot overlords take over, give us a call at 800-710-0455 or email us.

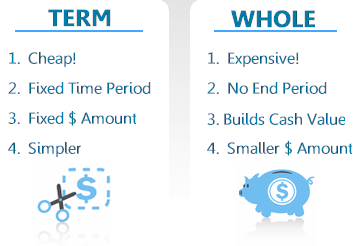

No exam life insurance is quickly becoming the go-to process for the market so we put together a comparison here with term and whole life options (non-medical exam):

Again, give us a call at 800-710-0455.

Our assistance is 100% free to you!

Yes.

The both mean the same thing.

Basically, a plan that WILL pay a death benefit as long as you pay the premium.

Both the same thing.

Term life pro's:

Term life con's:

Whole life pro's:

Whole life con's:

Those are the core benefits and issues with both term and whole life.

Generally, cost is king.

You have to be able to afford the coverage over a long period of time.

We're happy to help you compare.

You can quote both options here:

Whole life is really the combination of two things.

It has an immediate death benefit that's usually smaller

Secondly, whole or permanent life insurance plans have a side component...cash value.

Essentially, this part will slowly build over the life of the policy.

In many ways, this is an asset that you (or the beneficiary if you pass away) will own.

You can borrow against this cash value portion and even use it to pay premiums in some situations.

The theory is that you are paying much more in premium but you will have this growing store of money which will ultimately pay out as a death benefit.

The problem is the cost.

This cash portion is expensive for what it is.

We're happy to help you understand this aspect and compare it with term life.

Just call 800-710-0455 or email us.

You can quote term or whole life here.

Better for whom?

If you mean better for the life insurance carrier or the life agent...WHOLE LIFE!

By far!

If you mean better for you, the insured...

Let's look at the two "talking points" used to push whole life.

You'll build up this nice cash value!

We'll break those down (and then apart).

So much for guaranteed.

Secondly, insuring 100% of any risk (be it car, house, health, etc) makes no sense.

Those big skyscrapers in every major city don't come cheap!

A guaranteed death benefit means you're probably paying double that amount in premium.

We also have to take a much smaller death benefit due to cost versus term life.

That defeats the purpose of what we're trying to do.

Would you rather leave $50K or $500K?

What about the second piece...the much ballyhooed cash value?

Small print...

After we take out:

There's been a real push in the investment world to both publish and bring down expense ratios.

The "cost" a mutual fund or etf charges to manage your money.

It's front and center now.

Good luck getting close to that with whole life cash values.

The mechanism resides behind a thick, black curtain.

It doesn't make sense to pay a dollar to get maybe 65 cents back.

Get term life for a longer period of time and invest the difference.

It's easy and very important.

Seeing the premium difference usually answers the question pretty quickly.

How to quote term and whole life:

It's invaluable.

The quotes are just quotes with life insurance.

Your health and situation really affects what the best ACTUAL rate will be.

Call us at 800-710-0455 or email us to learn how to work the system.

This is where a little hand-holding really helps!

It will save you time, money, and sanity!

To enroll in term or whole life coverage:

We can take a one hour process (completing online or paper application)

And condense it down to 10 minutes.

More importantly, you'll make sure you have the rate and quote.

Health and background information can change the best approach in terms of cost.

There's no way around that.

Use our 25+ years experience to find the best rate.

We want to find the plan that you want to keep!

It's pretty clear on our opinion regarding term versus whole life.

We're in good company.

For a good reason!

Whole life takes advantage of people's misunderstanding regarding cost and risk.

For some people, it feels really comforting to know there WILL be a benefit.

Many people have a almost a religious avoidance of paying for something they may never use.

They just can't wrap their heads around it.

Life insurance (or any insurance really) is tricky.

We hope to never need it but if we do, it's so so important to everyone we love.

The goal then is to reduce the cost as much as possible.

It's in your interest financially.

Of course, we're happy to help you explore these options.

Call 800-710-0455 or email

us with any questions.

There's no cost for our assistance. Zero.

It's in our interest and yours.

Again, there is absolutely no cost to you for our services. Call 800-710-0455 Today!

and more!

and more!

20+ Years EXPERIENCE

"No Thank you. You've been so helpful time and time again!"

"Thank you SO SO much for all your help. I have to be honest, this insurance stuff was making me so nervous. Thank you again for your assurance"

"Anyway, I hope you got some time off this past week! Thank you again for your help and efforts on my behalf! I was very lucky to find you."

"Thank you so much! Very happy with service. If there is any way I can contact supervisors to let them know about your great service let me know"

"Yay! Thank you so much. YOu guys most definitely made it so much easier!"

"You are awesome... takes a huge worry off my back, thank you for your kind. thanks for your time and kindness. !!"

"Wow, I can't thank you guys enough for your help...I couldn't imagine trying to tackle this on my own!"

"Thank you so much for your marvelous work. Can't tell you how much I appreciated you taking care of this. You are simply the best!"

FAST TERM LIFE INSURANCE quotes online

We are licensed term life agents with comprehensive insight of term life plans, options, and eligibility.

We'll quickly see if you have the best priced term plan on the market

877-449-6387This website is owned and operated by Goodacre Insurance Services, which is solely responsible for its content.